#JoeNgPropertySolution, achieve your retirement simple and earlier.

🧐You’ve probably heard your peers or seen social media posts about people making a “𝐠𝐨𝐨𝐝 𝐩𝐫𝐨𝐟𝐢𝐭” from private properties.

But while others 𝐝𝐨𝐧’𝐭?

🥹But what many “𝐝𝐨𝐧’𝐭 get 𝐬𝐡𝐚𝐫𝐞” is the deeper truth “ 𝐖𝐇𝐘 ” they are doing this despite many uncertainties like affordability , fear of unpredictable economic environment etc….

Because they understand exactly who is our biggest enemy in Singapore, “ High 𝐋𝐢𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐄𝐱𝐩𝐞𝐧𝐬𝐞𝐬 ”.

"They are not just buying property..... they are Escaping the Rat Race."

"If you believe that simply maintaining your current job 8 to 5 will be sufficient to manage the " increasing expenses" caused by inflation ?

🆘 You may be

underestimating

the severity of your situation."

👋🏼Dear readers,

especially in your 30s and early 40s. I hope you are doing well. Probably you are still enjoying your youthful working years, dining out, holidays, and indulging with your friends right now.

⛔️🖐️ Let's take a moment to think about your life and all the dreams you want for your future retirement.

🧐 “Do you actually know how much is required for your basic needs at 65?

Have you taken steps to plan for your retirement and are you on the right track ?”

🧐Or ever thought about leaving a “Legacy” for the next generation, especially

for those who are parents?

(Isn't it a Love of all parents and Goodwill for their childrens and how we want to be remembered )

Learn how to " Make Inflation Your Ally— let it " work hard" for you while you sleep."

I’ve written a simple article breaking it all down step by step on how you can turn your current property into a tool for Early Retirement Safely.

⚠️⚠️⚠️Note: It’s

not a quick read, but it’s 𝐰𝐨𝐫𝐭𝐡 it if you’re ready to ”𝐭𝐚𝐤𝐞 𝐜𝐨𝐧𝐭𝐫𝐨𝐥” of your future.

⚠️⚠️⚠️this is only for those who are truly keen to understand how to make property work for you, this is your starting point.

🆘Hence using an iPad or Laptop is recommended.

1️⃣ Do you know how much Basic needs retirement funds needed for retirement? Can you save up the money by working hard?

2️⃣Why we need to build Net-Worth via Assets?

3️⃣Are you holding onto the right Asset?

4️⃣Did you know that despite the increasing property value over time, you might end up with $0 cash proceeds due to holding costs after the sale if you are holding your property in the Wrong way?

5️⃣Example of

(

Resilient Bullet Proof Checklist property Frame Work for choosing the right property❗️)

6️⃣ Saving in Real Estate vs Hardworking, which is Faster ?

Continue part 2

Based on the study done in 2024/2025,

suggests a single elderly 65, will require an estimate of $1600 for basic needs retirement a month.

The amount to last from 65 to 85 years old will be

$384,000

🖐️ Let's take a moment to imagine your future.

You‘re now 40, and there are 25 years ahead until you reach 65.

Given Per annum

inflation rate

of an average, of 3%.

You will need $804,000 to ensure your lifestyle maintains at its Basic Needs during these years of retirement at 65 to 85.

For married couples, the financial goal doubles to $1.6m to secure a basic needs retirement for both.

⚠️Note: Above it's just for " Basic needs " of current 2024/2025 value @ $1600 per month in 25 years later.

⚠️You will need “ More ” if you wish to live " Comfortably ".

Next Important Question to ask yourself?

You will be

reaching

a certain age one day where you will decide to sell your flat and

downsize

to a smaller house like a

newer

HDB 3-room flat to

cash out for retirement.

Putting the scenario above, you may require

$804k for single or

$1.6m for Married couples for

Basic Retirement

needs

in

25 years.

Now ask yourself:

🧮 At your

current asset level, after accounting for the resale price of a 3-room HDB flat above,

What will your net worth look like at age 60–65?

👉 Will it be enough for your Retirement?

2️⃣ Why Need to Build your

Net-Worth via Assets?

Over

the last 15 years between 2008 to 2023, the property price index has

Risen

Significantly by

118%, (

inflationary effect)

while our medium Monthly Household Income has grown at a slower rate at only 78 % in comparison.

But let’s not just look at the index.

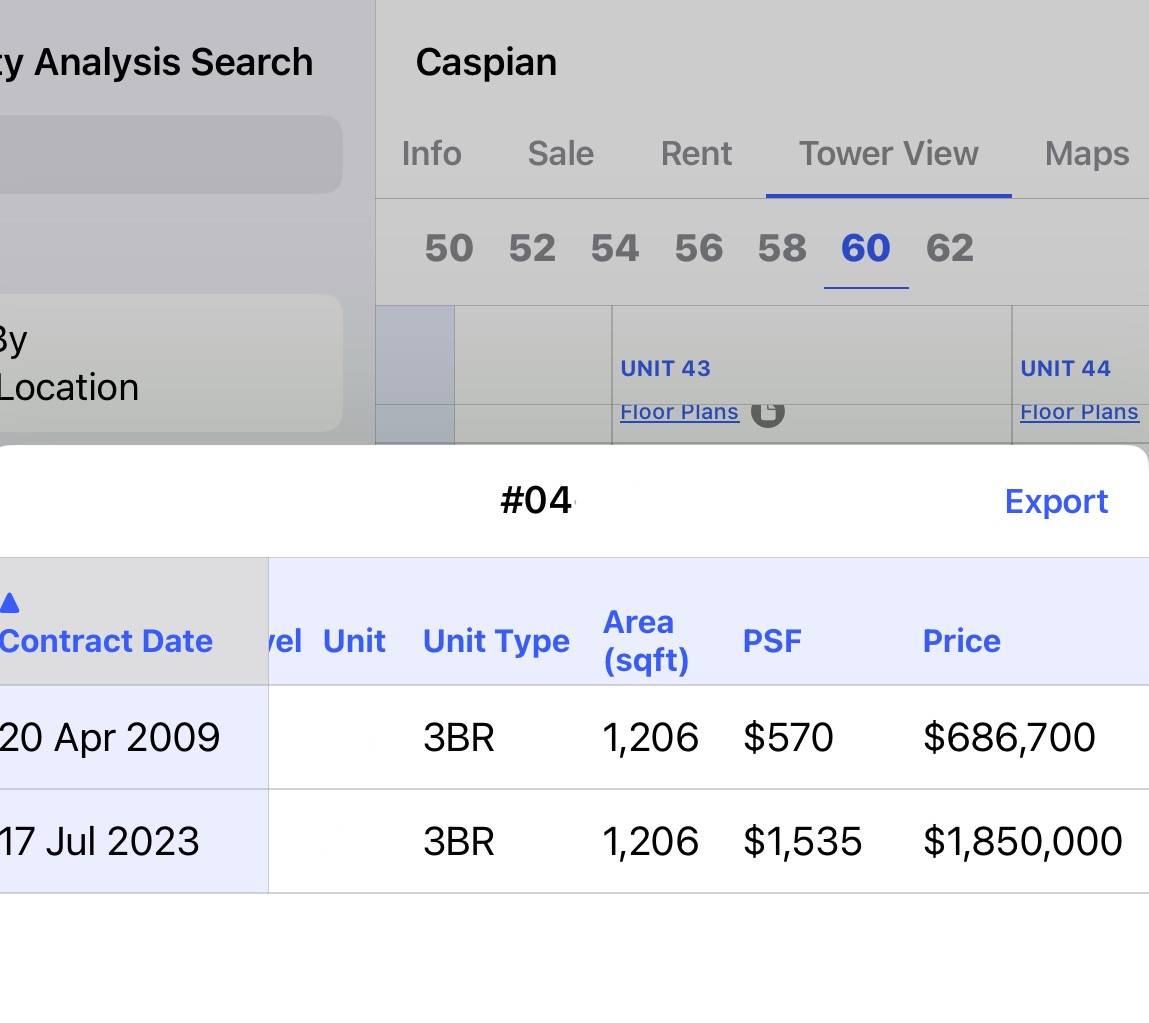

Let’s take a real example — Caspian condo.

Back in 2009, a 3-bedroom unit @ level 4, was purchased for about $686,700. In 2023, the same unit was sold at $1,850,000 with $1.163m profit.

That’s almost 2.7 times the original price — or about a 169% increase in value.

This highlights the " risk "

If you only depend on your salary savings, your income simply doesn’t grow as fast as property values.

But when you own a property, your asset is growing with the market — sometimes even faster , like the Caspian condo which grew by 169% in 14 years.

That’s why property isn’t just a roof over your head — it’s a financial tool to stay ahead of inflation and income gaps.”

" Don't wait " to buy Real Estate. Buy Real Estate and " wait ."

Real Estate is the ideal Saving Plan to " Haedge" against inflationary periods.

“I sincerely encourage you to continue reading our research and insights below, as your future financial will determine the choice you make today.”

Let's embark on this journey together to secure the retirement you deserve.

Case Study:

Making the right choice is the KEY for success!

Remember: Your choices

today hold the power to shape your future over

the next

5 to 10 years.

I will be using Queenstown HDB estate for this case study.

Block 5 Holland close with excellent location to Holland Village MRT Station (Circle line) and Shopping Malls.

The sale of the above resale HDB unit of size 1334 sqft, sold at $1.13m in 2024. To me is considered a good deal for a 1998 resale HDB flat.

But If we examine the figures more closely. It turns out that if the owners were to hold onto their HDB flat for a good 13 years till date, and during that time, the property value appreciated amounted to only $335k. $26k Per year in profits . In my humble opinion, it's not a significant gain .

Is essential to understand the Bigger picture here, the government's objective is very clear to keep and maintain stability in the HDB resale market to make sure that every Singaporean can afford to own an HDB flat.

Possible Negative sale?

Do keep in mind that when you're holding property with a loan and using CPF for monthly payments, there will be some continuous running costs!

1️⃣ Loan amount interest rate from 2.6% to 4% yearly.

2️⃣ CPF interest rate @ 2.5% yearly if you are using your CPF for monthly housing mortgage loan repayment or

even have fully paid.

For property owners with

urgent financial needs, selling a house is often a last resort, particularly for crucial expenses like children's education.

However, if the house has negative equity, even this last resort may not be possible.

VS

"Bullet -Proof resilient" property nearby within the same period of timing between 2013 to 2022 year.

However if you look at nearby neighboring private condo, experienced a significant increase in value of

$837k

in just 5 years

comparing to HDB in same area.

But Only if you know HOW to choose a Right Asset.

🧠 Real Estate Rule:

“Don’t fall in love with the house — fall in love with the numbers.”

🏡 A beautiful home can steal your heart…

💸 But only the numbers will protect your wallet.

✅Learn how to apply our

8️⃣ Resilient Bullet-Proof Checklist

property Frame Work to assess if it is a Right Asset.

"Bullet -Proof resilient" Property in 4 years.

"Bullet -Proof resilient" Property in 4 years.

"Bullet -Proof resilient" Property 4 years.

"Bullet -Proof resilient" Property in 4 years.

"Bullet -Proof resilient" Property 4 years.

I want you to know that I understand the

stress and

uncertainty you are feeling because I have been there myself.

I made the same leap from Hdb to 2 private condos in 2016.

I have walked in your shoes, and I get it.

However, I want to assure you that there are safe ways to navigate this terrain in today's environment by using:

-TDSR "PLUS" financial calculation,

to make sure you are safe to proceed,

-Risk Assessment Management(RAM),

to have a predictable plan in case you become

self-employed,

-Mortgage Tenure Technique with FiftyFive/RP/RF strategies ,

-OPM DK Technique,

-3PS Technique ,

-S.A.Y.E Technique ,

To reduce your monthly installment or holding cost so your risk will be at the minimum.

So If you bought your HDB flat more than 5 or even a 1st timer?

✅ Learn how to Upgrade your family lifestyle by applying a Predictable plan with extra Funds for "rainy days" like many Stress-Free homeowners without ❌risking your hard-earned savings,

or

If you are looking to Safely build your capital for a comfortable retirement or even looking to build a generation capital fund for your loved ones?

In order to make the article short and easy to read, I had broken it down into

part 1 and

part 2.

If you’re keen to understand more Research and insights, which are of the utmost importance,

please click the below link👇

Topics to be covered: knowledge & Step by Step strategies.

1️⃣ Clarify the Misconceptions about buying property (Real Estate) a Investment than Saving .

2️⃣How to have a predictable plan like many successful owners can have a choice to only sell and make profits in the upmarket?

3️⃣How to achieve a Guarantee result.

4️⃣ OPM Recycled Capital Extraction Strategy

( Inspired by Robert Kiyosaki )

5️⃣When is the Right Time.

6️⃣ Powerful messages that you must know from many successful owners for you to take immediate action.

Copyright © 2024 Joe Ng

#joengpropertysolution achieve your retirement simple and earlier.

All rights reserved.

No part of this site may be reproduced or reused for any other purposes whatsoever without our prior written permission.

Joe Ng Propnex Realty Pte Ltd

CEA Licence No. L3008022J/ R009874H

Phone No. 90265006

#JoeNgPropertySolution, achieve your retirement simple and earlier.

Sharing is caring. If you Know someone who will benefit from this article, share it with them.